Many young adults today somehow forget that they actually have a future and who can blame them, their upbringing did not expose them to personal finance at an early age. Not knowing about finance is a problem however like any problem it can be fixed, so learning takes you to the basics, and once you understand this basic then the rest falls in place.

One of the common financial mistake young adults make is spending too much money on rent, this one hits so close to home. I had a conversation with a friend about another friend that was obsessed with living on the “Island” even though she knows she is not at the level to cover the expenses that comes with such livelihood. This problem is common all over the world and financial experts would advice that you spend no more than 30% of your income on rent.

Another common financial mistake young adults make is not saving for retirement, many of you millennials believe you would be forever young, well that’s not a possibility so its only wise that you begin saving for retirement now because its a surefire way to ensure that you are comfortable financially when you are at the retirement age. Aside’s this when you save, the compounding interest would inspire you to save more.

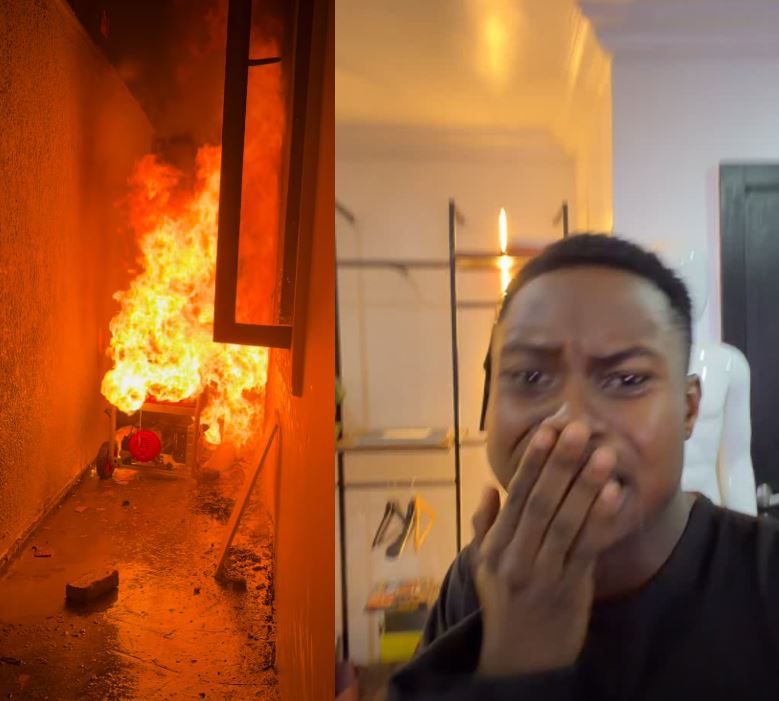

The financial experts advice that if you want to get a handle on your finances then its time to start an emergency savings account. This account should have up to six months of living expenses so that if or and when you loose your job, you wouldn’t have to jump on another one all because of a pay check. This savings would be your financial cushion.

As a young adult your biggest asset is not a home or investment, rather its your ability to earn so makes sure you’ve made the right career choice.