10 cost every Nigerian business must incur

By ‘every business’, we address a broad spectrum of businesses from the MSME to the large corporations.

1. Cash cost

Every business relies on cash for either sales or purchase transactions. Doing so comes at a cost either way. This also applies to the unbanked individual who has no bank account.

For instance, according to the Central Bank of Nigeria (CBN), the currency in circulation as at March 2022 was N3.24 trillion while the currency in circulation outside the banking sector is N2. 73 Tr. For the owners of the N2.73 Tr outside the banking system, whilst they do not incur bank cost such as C.O.T, VAT on C.O.T, bank fees, charges etc, costs are incurred when it is stored even in unconventional places. Apart from safe houses and vaults, other unusual places such as ‘under a mattress’.

These costs are similar to the costs associated with those who incur C.O.T charges for their bank deposits.

To put it succinctly, the banked and unbanked individuals are not exempted from the cost of losing money through any means, which could be the collapse of the bank, bank theft and so on.

The high level of costs incurred could be more if the CBN report on money supply is anything to go by.

2. Logistics

This is a cost every business in Nigeria is most likely to incur. The means of transportation either by road, air or sea notwithstanding, goods and services are always moved from one location to the other, and this will always involve some form of payment. There are no exceptions here. This sector is currently experiencing a boom due to the rise of online retail businesses which needs the support services of logistics to fulfil.

3. Phone Bills

It can be argued that phone bills do not qualify as a direct cost. However, since the introduction of telephony services in the country, it has become an indispensable part of business life. Every day, the ordinary roadside plantain seller has to make a phone call to the truck driver supplying her plantains to confirm the day and time of delivery. The handyman, artisan, cart pusher et al., need to be contacted in order to confirm their availability. Purchasing phone airtime is an almost daily cost for every business owner. It’s no surprise then that the players in the telecommunications industry continue to experience growth.

4. Levies

Unions, government agencies, local authorities, community representatives, palace representatives, motor park touts etc all have one thing in common – Levies.

Business in Nigeria of every size and function pay all sorts of levies to various regulatory authority under which their businesses operate. Admittedly, some levies are paid to illegal authorities, but nonetheless, business owners are being made to pay levies in one form or the other.

Bus conductors for example pay levies to motor park touts and unions, just as importers of goods pay to touts (when transporting the goods from one location to the order) and to port authorities. Levies are an everyday transaction cost which every business must grapple with. You cannot avoid levies even if your business is operating online. For online business subscriptions, membership fees are not an uncommon cost.

5. Power

Power, in the form of electricity or alternative sources, is definitely a cost every household must incur, let alone businesses. Citing the market woman who trades at night, she needs power in the form of candles or kerosene or oil to light her lamp which is a purchase that must be made. For other businesses, it is the cost of electricity bills or alternatively the cost of fuel to power generator sets. Even the ‘Okada’ rider needs a torchlight to ride through unlighted streets in Nigeria. Like the others, power is sacrosanct.

Provided via the local authorities, every business must incur its associated cost to remain competitive.

6. Rent

Surprisingly, some local water cart pushers factor “rent” as a cost which determines the cost of supplying water. Rent is in the form of tokens paid to secure a space for their cart under the bridge, to ensure that their space is not taken by other intending cart pushers.

Rent is paid by every business in Nigeria as there is no free (pro bono) space or accommodation. Payment is either to the state or private authority. To ease the cost of rent overheads, a lot of brick-and-mortar small business owners work in shared office spaces; however this is not applicable to all businesses as some still need to rent their own space. Either way, money parts ways for any space used for business.

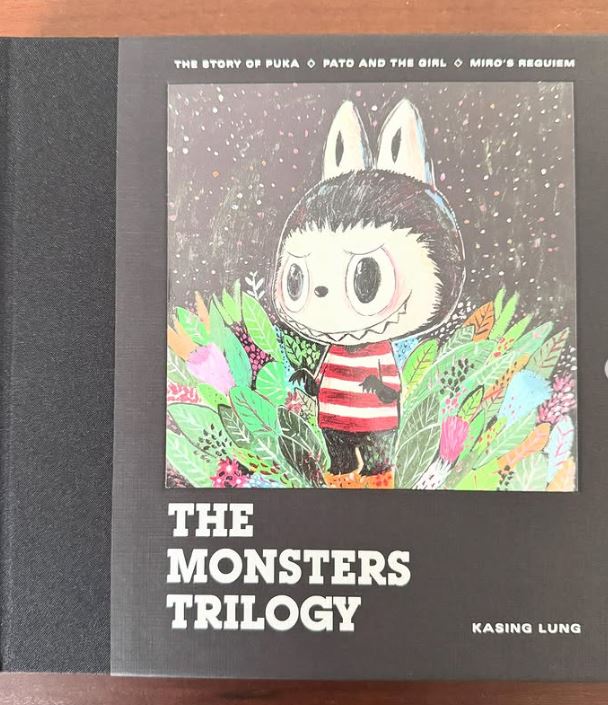

7. Stationery supplies

Even the unlearned fruit hawker selling in a densely populated part of town will have his mother scribble down the daily transaction in paper.

Just like the big multinationals, the street trader with a small butcher shop relies on some form of stationery to record his daily business transactions. The costs of course vary from the operational size of one business to the other, but nevertheless, it is a cost every business must incur.

Although the use of paper seems to have reduced significantly as a result of online documents, stationery in some form or the other is an expense that should be factored in.

8. Health Cost

Health is wealth and is directly related to the labour force. As such, manpower is lost when the disease burden of a nation is high. The economic survival of every business depends on the mental, physical and emotional well-being of its sponsors, owners or employees. Good health does not come cheap, especially with orthodox medicine. Nigerians spend much yearly on medical costs and N576 billion on medical tourism. The low-income earners on the other hand, rely on traditional medicine or even orthodox medicine accessed via government health care facilities, depending on the ailment.

9. PR Cost

Every business incurs this at some level of its operations whether it is implied or not. From bribing the local transport authority to get a transport license, to obtaining town planning approvals for a development project, every business must incur this cost one time or the other. It’s one of the “Seven wonders” of doing business in Nigeria. Some of these costs are not officially recognized by regulatory authorities despite its ubiquitous nature. But we do know it exists and so must include it here.

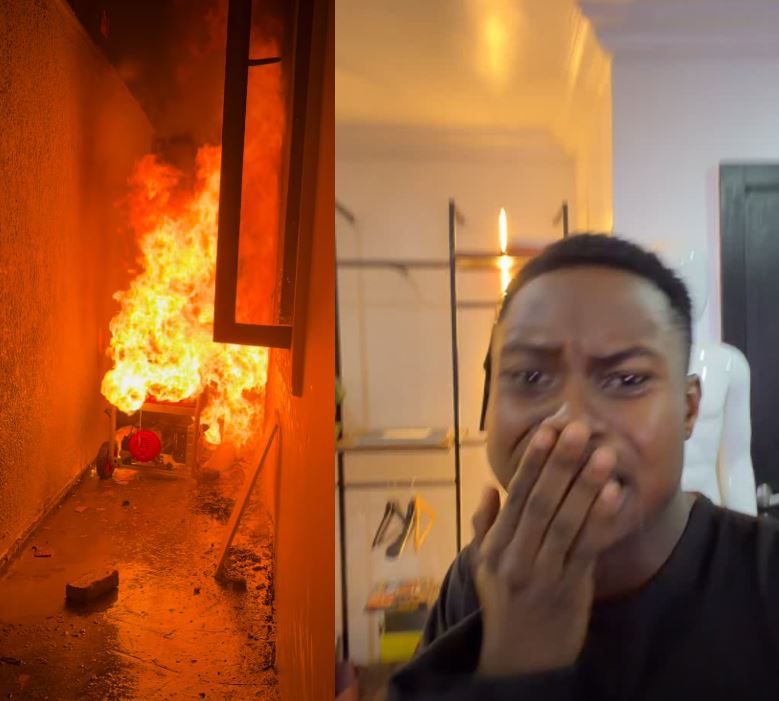

10. The financial costs associated with a corrupt society

Although not typically a cost involved in running a business, Corruption is very peculiar to Nigeria and is at an all-time high. It affects every aspect of business and individuals and knows no relation. Even a close family member or relative entrusted with a commercial housing project is out to be fraudulent. Employees are also all out to covert a company’s resources. Some unemployed graduates are daily scheming to scam individuals and businesses via internet fraud.

Be that as it may, these costs come across as a necessary evil of doing business, that business owners have to face. Even some of the PR costs earlier mentioned are done with some form of illegality.

Such is the nature of this cost to the economic growth of the country, that the government had to set up EFCC, ICPC in addition to the police and other anti-fraud agencies to fight it to the end……well, hopefully.

Did we miss any? Comment and tell us if we did.