Man shares how PoS operators access your bank account without your ATMs

A man has shared how technologies used by most PoS operators can store and retrieve your bank details without your ATM details.

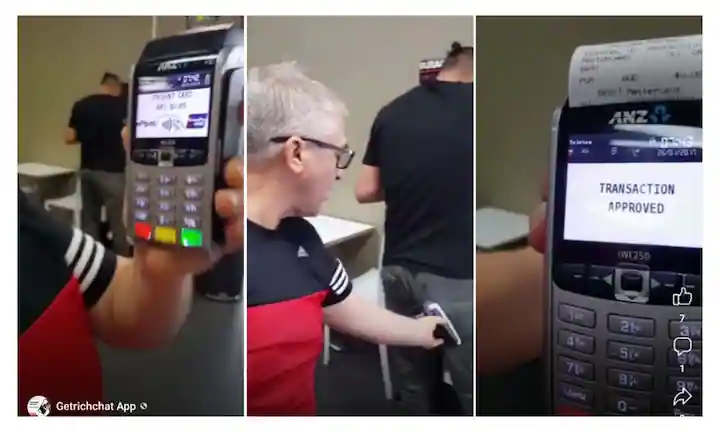

In a video posted on social media, a man was seen with an ATM tapping another man’s back pocket containing his financial cards.

The video shows the ATM printing out what appears to be a transaction receipt after the man’s back pocket gets tapped.

They revealed that it is part of a contactless technology being developed by top companies to ease transactions worldwide but could be exploited by criminals.

In recent years, banks and other top financial institutions worldwide have sought ways to ease customer transactions.

It is still being determined which company developed the latest technology, but checks reveal that they are gaining popularity among merchants and businesses worldwide.

In Nigeria, PoS uses are at their peak, employed by financial companies which seek to ease transactions across all formats and touchpoints.

Analysts worry that cyber criminals could exploit the latest technology in Nigeria to access and steal from unsuspecting victims’ accounts.

Some banks in Nigeria are already touting contactless technology to eliminate time and save costs.

TechPoint reported that the Nigerian neo bank would launch a SoftPoS feature, enabling users to accept smartphone card payments.

SoftPoS permits customers to accept contactless cards and turn their smartphones or tablets into a secure payment terminal or Point of Sale (PoS).

The feature runs on Android version 8.0 or higher with an NFC module, while payments can be made using plastic or virtual cards.