According to a recent report by the World Bank, 26 of the world’s poorest nations are experiencing their worst debt crisis in nearly two decades. Many of these countries, mostly in Africa, have been hit hard by a mix of global economic challenges, leaving them struggling to manage their rising debts.

According to the world bank, the 26 nations examined are home to some 40 per cent of the global population most affected by poverty.

It added that 22 of the 26 low-income countries listed are in Africa, plus Afghanistan, Syria, Yemen and North Korea.

The report highlights that this is the worst debt situation since 2006, a time when many countries were just coming out of severe economic downturns. Fast forward to today, and it seems history is repeating itself, with poor nations sinking deeper into debt. Inflation, rising interest rates, and the impact of COVID-19 have all played a role in pushing these countries into financial distress.

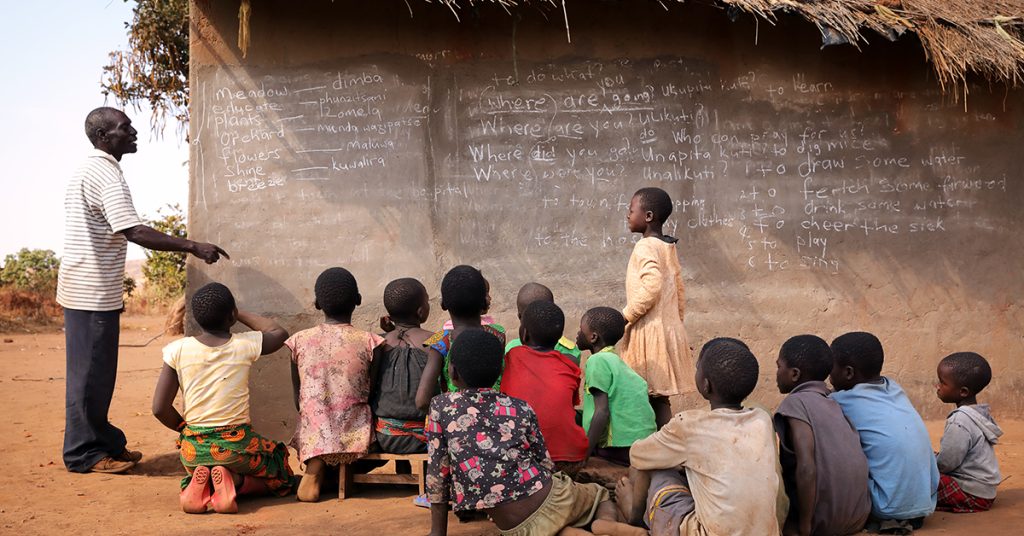

For the average Nigerian, this news hits close to home. Many people across Africa, including Nigeria, are feeling the squeeze as governments struggle to balance their budgets. This means less money for essential services like healthcare, education, and infrastructure, all while the cost of living keeps rising.

The World Bank is urging global leaders to act quickly to help these nations manage their debt. However, for everyday citizens, it feels like a familiar story—countries borrowing more money but not seeing enough improvement in their daily lives.

As the world watches, there’s hope that the international community will step in to provide relief, but until then, many Nigerians and their African neighbors will continue to face the realities of a struggling economy.