The belief that hard work alone builds wealth is deeply ingrained in the American Dream. However, a closer look at economic inequality reveals that systemic factors often play a larger role. Author Terry Pratchett’s “Sam Vimes ‘Boots’ Theory of Socioeconomic Unfairness” sheds light on this issue, offering a simple yet profound explanation of how poverty perpetuates itself.

What Is the Boots Theory?

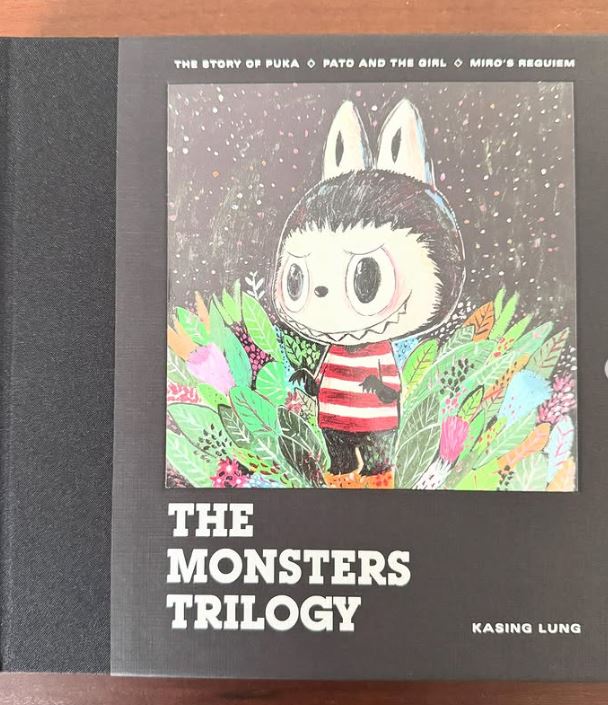

Terry Pratchett, in his 1993 book Men At Arms, illustrates why being poor can be so expensive. Recently shared on his official Twitter page, the Boots Theory demonstrates how wealthier individuals save money in the long run by investing in higher-quality goods.

Pratchett wrote:

“The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money.

Take boots, for example. He earned thirty-eight dollars a month plus allowances. A really good pair of leather boots cost fifty dollars. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about ten dollars.

But the thing was that good boots lasted for years and years. A man who could afford fifty dollars had a pair of boots that’d still be keeping his feet dry in ten years’ time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet.”

In essence, people with more money can make smarter long-term purchases, while those with limited funds are forced to settle for cheaper, less durable options, ultimately spending more over time.

Why Poverty Is Expensive

Pratchett’s theory doesn’t just apply to boots—it reflects many aspects of life for those living paycheck to paycheck.

- Bulk Buying vs. Single Purchases

Buying in bulk saves money in the long run, but only if you can afford the upfront cost. - Reliable vs. Cheap Cars

A dependable car may cost more initially but saves on repair costs over time. However, many people can only afford a used, unreliable vehicle, which ends up being more expensive due to frequent breakdowns. - Interest Rates and Credit Scores

Those with higher incomes can make larger down payments and qualify for lower interest rates, reducing overall costs. Conversely, people with poor credit or little capital face higher rates, further straining their finances. - Access to Financial Tools

People with disposable income can use credit cards, pay off balances, and build good credit. This access enables them to secure favorable loans and grow their wealth, creating a cycle of financial stability that remains out of reach for many in poverty.

The Cycle of Poverty

For individuals living in poverty, climbing the financial ladder often feels impossible. While advice on building wealth is helpful, it assumes access to resources many poor people simply don’t have.

The first step to escaping poverty is reaching the bottom rung of the ladder, yet that rung is inaccessible for many. High costs, systemic barriers, and the lack of a safety net keep people stuck. As the Boots Theory illustrates, being poor often forces people into short-term decisions that cost them more in the long run.

Understanding Socioeconomic Inequality

When we talk about how difficult it is to escape poverty, this is what we mean. The ladder of financial success isn’t always within reach, and the costs of poverty compound the problem. Yet, assistance programs that could help people access the ladder often face criticism, usually from those who started life on the ladder without realizing it.

Pratchett’s Boots Theory helps explain the reality of poverty:

- Money makes money. Those with financial resources can invest in quality goods and services that save money over time.

- Poverty costs more. The lack of capital forces the poor to make expensive short-term choices.

Final Thoughts

Terry Pratchett’s Boots Theory highlights a harsh truth: wealth builds wealth, but poverty perpetuates itself through systemic barriers and financial constraints. By understanding this reality, we can foster greater empathy and push for solutions that help people escape the poverty trap.

Thanks, Terry Pratchett, for this timeless lesson on socioeconomic fairness.