Our problem isn’t always a lack of money but the deep-rooted money beliefs most of us grew up with. We were raised on sayings like “Money is the root of all evil.” “Children bring wealth.” “When you help your parents, you’ll become richer.”

Those beliefs might sound moral or cultural, yet they’re quietly sabotaging your finances. If 2025 is truly your year of “soft life”, it’s time to unlearn wrong money beliefs that keep you working hard but not as smart.

1. “Money Is Evil”

This financial mindset traps people in a cycle where they want money but also feel guilty for having it or think it’s out of their reach. It’s why some people reject good opportunities or act like being broke makes them humble.

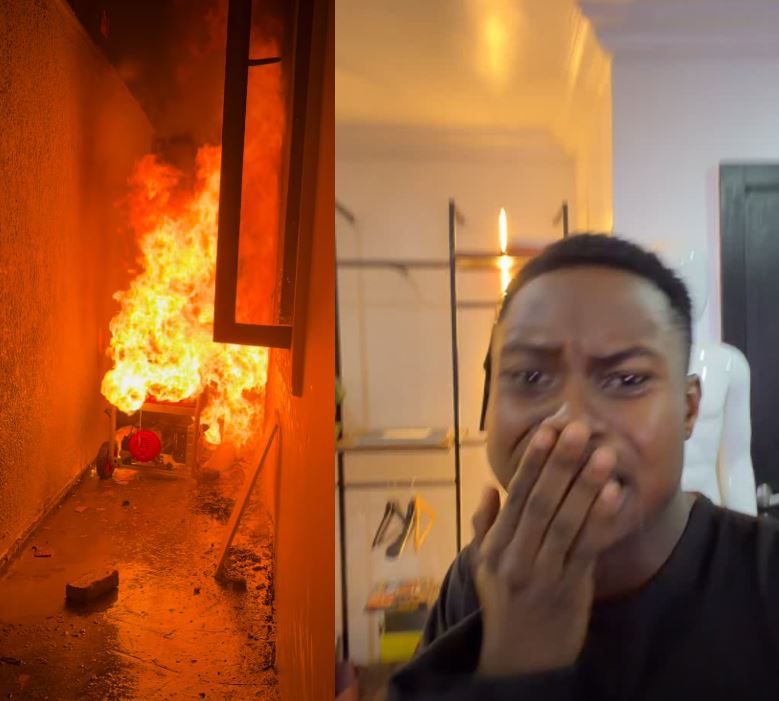

But money isn’t evil. Just like fire can cook food or burn a house, money amplifies who you are. A kind person with money can do good; a greedy person just becomes greedier.

2. “Children Bring Wealth”

But in a country where school fees and living costs keep rising, that belief can bury you in debt and regret. Children are blessings, but they don’t bring wealth by default. You create the wealth that sustains them.

What to do instead: Plan family finances before expanding. Save for your kids’ education, teach them money values early, and stop banking your retirement on them.

3. “Helping Your Parents Will Make You Rich”

Truth is, honouring your parents doesn’t mean overextending yourself. Giving beyond your capacity doesn’t make you rich, but resentful.

It’s okay to help, but it’s also okay to say, “I can’t right now.” If ‘it didn’t dey, it didn’t dey’. (If you don’t have it, then you don’t have it.) Set a monthly “family support budget”. Communicate your limits respectfully and consistently.

4. “Once I Earn More, I’ll Save More”

That’s the income illusion. It’s the false belief that higher income means better money habits. In reality, if you don’t manage ₦100k well, ₦1 million won’t save you either.

What to do: Automate savings using apps like PiggyVest, Cowrywise, or Kuda. The goal isn’t to earn more before saving but to save better at any income level.

5. “Hustle Now, Enjoy Later” — The Lie That’s Draining You

But many Nigerians are realising that “later” never comes. You hustle in your 20s, struggle in your 30s, and before you blink, you’re burnt out with no peace and money to show for it.

Hustling nonstop without a strategy isn’t ambition. The goal isn’t to work till you collapse; it’s to earn smart, invest in assets, rest well, and enjoy your life while you still have energy. Learn skills that make money while you sleep.